It is FY26, and the economic landscape in India has shifted. With the RBI, led by Governor Sanjay Malhotra, successfully pinning inflation down to roughly 2%, the rules of wealth generation have changed.

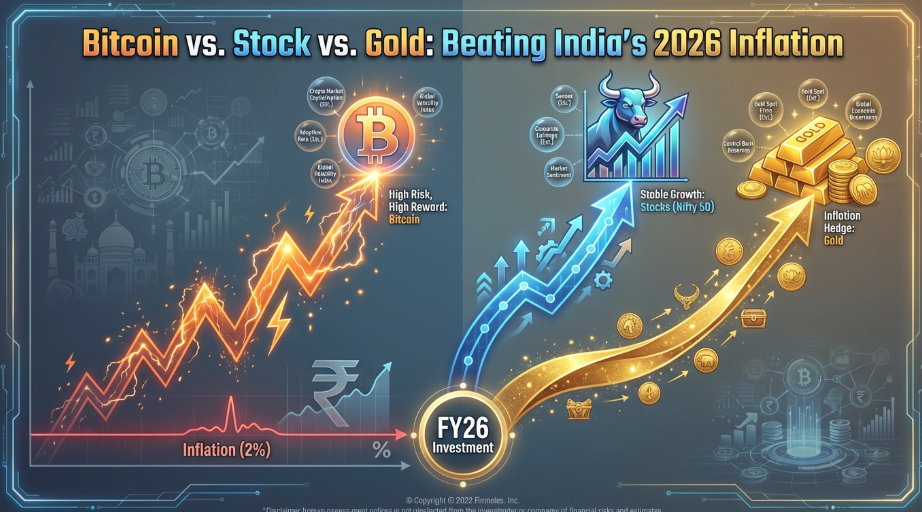

In FY26, India’s economy entered a low-inflation phase, with CPI near 2%. This shifts investing from capital preservation to real wealth creation, but new tax rules and market cycles demand a more selective approach. Here’s the practical outlook for Bitcoin, stocks, and gold in 2026.

Key Takeaways:

- Real Returns: With inflation at 2%, assets earning 6%+ deliver strong real wealth without extreme risk.

- Bitcoin: Not a halving year; performance hinges on institutional adoption, implying volatility over guaranteed upside.

- Gold (SGBs): New SGBs are unavailable; access to the 2.5% interest requires secondary market purchases.

- Stocks: A 12.5% LTCG tax applies on gains above ₹1.25 lakh—factor this into net returns.

The Economic Scene: Why 2% Matters

RBI projections place CPI inflation at ~2% for FY26. This is huge. If you earn 7% on a fixed income instrument, your real return (return minus inflation) is a healthy 5%. Compare that to a few years ago when inflation was 6%, leaving you with mere peanuts.

- The Opportunity: You don’t need “moonshot” returns to build wealth. Stability pays off more than usual right now.

1. Bitcoin: The Aggressive Play

The 2026 Context: unlike the hype of 2024, there is no “Halving” event this year. We are currently mid-cycle. The price action in 2026 is driven by global ETF inflows and utility, not a supply cut.

- Performance: Bitcoin remains the only asset capable of delivering 40-60% annual swings. It crushes inflation, but it tests your nerves.

- Critical Warning: Be careful with where you buy. After the major exchange hacks of 2024 (including the WazirX incident), “liquidity” isn’t the only factor, safety is.

- Strategy: Stick to FIU-registered exchanges with clean security audits. Liquidity matters for execution, so when you are ready to enter, make sure to Trade BTC/USDT on platforms with deep order books to minimize slippage. Also, do not leave large amounts on exchanges like MEXC; learn self-custody.

- Verdict: Allocate 5-10% of your portfolio here for pure growth. Treat it as a 5-year bet, not a quick flip.

2. Stocks (Nifty 50): The Wealth Engine

The 2026 Context: With India’s GDP growth projected around 7.3%, the stock market is the direct beneficiary.

- Performance: The Nifty 50 has historically delivered 12-15% CAGR. In a 2% inflation year, that is a massive 10%+ real return.

- Sectors to Watch: With credit demand rising, Banking remains strong. FMCG is also looking attractive as rural demand stabilizes.

- Tax Note: Don’t forget the tax man. Long Term Capital Gains (LTCG) are taxed at 12.5% for profits exceeding ₹1.25 Lakh.

- Verdict: This should be your core portfolio (40-50%). Use SIPs in Index Funds or low-cost ETFs to smooth out market highs and lows.

3. Gold: The “Crisis Insurance”

The 2026 Context: Gold isn’t just jewelry; it’s a hedge against global chaos. If the Rupee weakens or global wars escalate, Gold jumps.

- The SGB Problem: Many investors still look for new Sovereign Gold Bond issues from banks. These have stopped. To get the tax-free maturity benefit and 2.5% interest, you must buy existing SGBs listed on the stock exchange (Secondary Market).

- Performance: Expect steady 8-10% returns. It’s boring, but in finance, boring is good.

- Verdict: Keep 10-20% here. If you can’t navigate the secondary market for SGBs, Gold ETFs are a liquid, hassle-free alternative (though less tax-efficient).

Head-to-Head: The 2026 Snapshot

| Feature | Bitcoin | Stocks (Nifty 50) | Gold |

| Primary Driver | Institutional Flows (ETFs) | GDP Growth & Earnings | Global Stability Hedge |

| Risk Profile | Very High | Medium | Low |

| Real Return | Potentially 40%+ | 10-13% (Consistent) | 6-8% (Stable) |

| Tax Impact | Flat 30% on gains | 12.5% LTCG (>₹1.25L) | Tax-efficient (if SGB) |

| Best For | Aggressive Growth | Long-term Wealth | Capital Preservation |

Final Verdict: What Should You Do?

There is no “best” asset, only the right mix for you.

- The “Sleep Well” Portfolio: 60% Stocks (Index Funds), 30% Gold (SGBs/ETFs), 10% Cash. You will beat inflation easily without stress.

- The “Growth Hunter” Portfolio: 50% Stocks, 20% Gold, 20% Bitcoin, 10% Cash. This exposes you to the broader crypto upside, potentially including emerging interests like the Pi Network, while keeping a solid safety net.

Next Step: Check your existing Gold investments. If you are holding physical gold, consider if swapping to digital formats (ETFs or secondary SGBs) makes sense for safety and returns. Avoid FOMO (Fear Of Missing Out), stick to your allocation, and let the 2% inflation rate work in your favor.

Frequently Asked Questions

- Is Bitcoin a better inflation hedge than gold in India 2026?

Bitcoin’s 60%+ returns outpace gold’s 8-10%, offering massive growth potential via easy platforms like MEXC.

- How do stocks perform against inflation in the Indian market?

Nifty’s 12-15% CAGR delivers consistent wins over 2% inflation, powered by GDP growth and dividends.

- What are the tax implications for Bitcoin, stocks, and gold investments in India?

Bitcoin: 30% on gains; stocks: 12.5% LTCG above ₹1.25L; gold/SGBs: Tax perks make net returns shine.

- Can I invest in Bitcoin legally in India to beat inflation?

Absolutely, use FIU-registered exchanges for seamless, compliant access to its inflation-beating power.

- What’s the ideal allocation for beating inflation with these assets in 2026?

Try 40% stocks, 30% gold, 20% Bitcoin, 10% cash, adjust for your risk appetite and reap 10-15% real returns.